In a historic move, the government of Bangladesh launched a first-of-its-kind universal pension scheme on Thursday 17th August 2023, aimed at providing widespread social security coverage to citizens across professions and economic backgrounds.

The ambitious scheme is projected to bring over 100 million Bangladeshis under its safety net, representing a monumental leap towards organizing and consolidating the country’s social security frameworks.

Prime Minister Sheikh Hasina inaugurated the pioneering initiative at an event in Dhaka, calling it a tool for reducing inequality. “From now on, professionals from every economic stratum will receive pensions, which will eliminate social disparity,” she said.

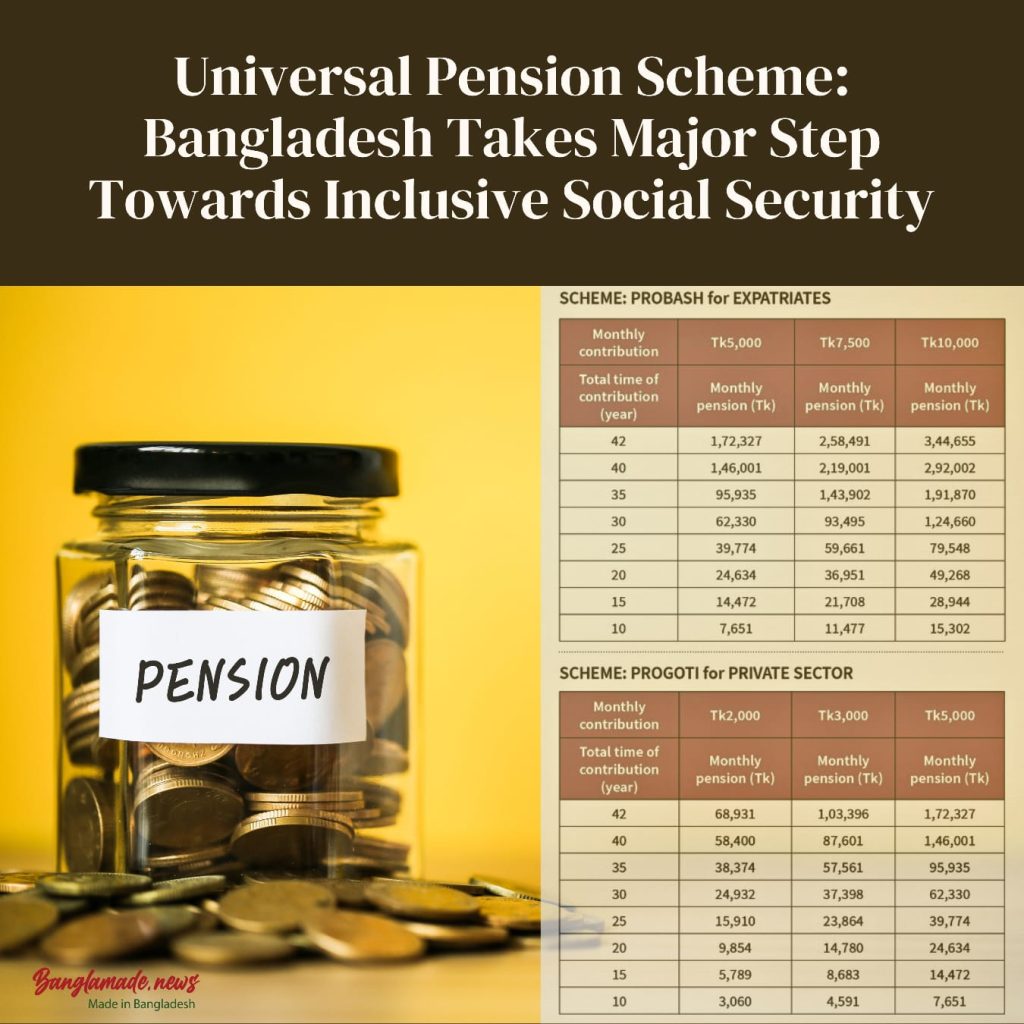

Four universal pension plans were introduced under the umbrella scheme – Probash, Pragati, Surokkha and Samata. Each caters to different beneficiary groups. Probash targets Bangladeshi migrant workers abroad, while Pragati is designed for private sector employees. Surokkha aims to cover informal sector workers like farmers, laborers, and small business owners. Samata is allocated for the poorest citizens.

Any Bangladeshi over 18 years can avail the schemes by making regular pension contributions. After retirement at age 60, they will receive guaranteed monthly pensions for life. According to projections, the payouts will be over 12 times the contributed amount over a 10-year period.

Citizens rushed to enroll as registration opened across branches of state-owned Sonali Bank and via mobile financial services. Authorities reported thousands completing registrations even on the very first day.

Financial experts have widely acclaimed the universal pension policy, calling it a major milestone for Bangladesh. They stated it will significantly enhance social security and support vulnerable groups in informal sectors often excluded from formal social protection mechanisms.

“The universal pension scheme is a visionary initiative and a welcome step towards establishing an inclusive and robust social security system. It promises a life of dignity for millions reaching old age,” said Dr. Mustafa K Mujeri, distinguished fellow at the Institute for Inclusive Finance and Development.

Effective nationwide implementation and long-term sustainability will be formidable challenges, analysts cautioned. Robust monitoring mechanisms are needed to prevent misuse and ensure timely pension disbursements across the far-reaching networks.

The launch of the scheme fulfills a longstanding commitment of the Bangladesh government. With the country’s aging population rising, organizing social security for citizens through a coordinated and inclusive system has been an urgent policy priority.

The universal pension roll-out aligns with the government’s National Social Security Strategy adopted in 2015. It is seen as a bold step towards consolidating fragmented social security programmes and expanding social protection for marginalized communities.

As Bangladesh crosses another milestone in its development journey with the pioneering social security initiative, experts have reiterated the need for accountable and transparent governance to translate the vision into reality.